Property details

Gold Working Interests | 1031 Eligible | 20X To 155X Equity Multiple, 15-Month Hold, Southwest Region

Property Description

Gold Working Interests | 1031 Eligible | 20X To 155X Equity Multiple, 15-Month Hold

Do you have property with multiple standby buyers who are capable of a quick closing, however, you cannot commit to a sale because there is nothing for you to 1031 Exchange into as a like-kind replacement property?

1031 eligible Gold Opportunity.

This is a major orogenic gold discovery on 7,500+ acres of mining claims under current operation.

The owners are in the final phase of development to negotiate a sale of the entire portfolio to a major mining company in approximately 15 months for cash, stock, and royalty.

To clarify, this is not a mining opportunity. The owners are drilling 24 and possibly more core holes to confirm the ore grade and conducting additional induced polarization (IP) surveys to measure the full size of the ore body. With the results, it is the owner's objective to calculate an inferred gold resource, update the NI 43-101 Technical Report, and negotiate a sale.

The owners are essentially adding a tremendous amount of value (ehhancements) to the property and then selling to a major mining company who must all fo the enhancements in place in order to justify the purchase. This sale to the end buyer has a projected return of 20 to 1 or higher.

For this investment opportunity, all investments will be structured as a direct working interest ownership in the mineral rights which are 1031 Eligible pursuant to 26 US Code 1031.

The owner has a NI 43-101 Technical Report which is available upon request. The NI 43-101, a requisite form document established by the Canadian Securities Administrators, is a 71-page, third party verified scientific report that compiles the data from the comprehensive evaluation (Phase I) USAE conducted on the property in 2019-20 with a team of world class geoscientists.

The total capital raise is $20 million

- This venture plans to negotiate the sale of the deposit to a major mining company within 15 months.

- The targeted sale price is projected to be between $2 billion and $15 billion in cash, stock, and a royalty.

- The discovery was made by eight core holes with extremely high gold assays in 1987-1988.

- The then claims holder disregarded the discovery due to old geology and old technology and let its claims expire.

- Years later a breakthrough recognition of orogenic gold deposits & technology advancements shed new light.

- A team of top global gold geoscientists has been assembled.

- The venture's $5M Phase II is now underway to determine the ore grade and deposit size and negotiate a sale.

- Phase II: drill 30 core holes, more IP surveys, etc., update the NI 43-101 report, & calculate an inferred gold resource.

- This venture bought the working interests in the claims and is offering %’s to accredited investors.

- To fund the $5M development, 20 or more units of $250,000 each are being offered to Accredited Investors.

- Each unit purchases a .25% non-dilutable and non-assessable turnkey working interest in the property.

- The investment is 1031 and 1033 exchange eligible and has certain tax benefits. Participants may consult a tax advisor.

- Partial units of $250,000 are available, however, the venture is seeking $20 million and would prefer one to a few total investors.

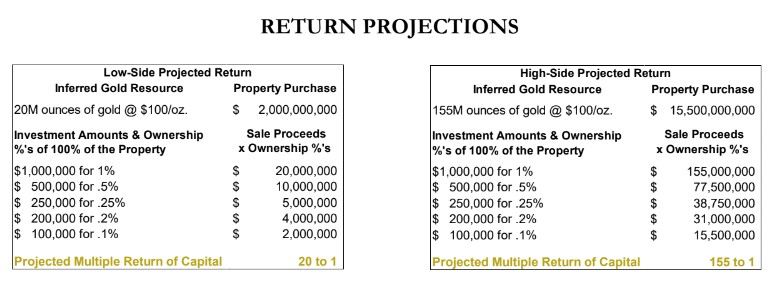

Potential returns are between 20 to 1 and 155 to 1.

Return Example (1) | Low-Side 20X Projected Return on sale at $2 Billion (within 15 months)

$20,000,000 buys 20.00% ownership interest of the Property, yielding $400,000,000 in Sale Proceeds

$1,000,000 buys 1.00% ownership interest of the Property, yielding $20,000,000 in Sale Proceeds

$500,000 buys 0.5% ownership interest of the Property, yielding $10,000,000 in Sale Proceeds

$250,000 buys 0.25% ownership interest of the Property, yielding $5,000,000 in Sale Proceeds

Return Example (2) | High-Side 155X Projected Return on sale at $15.5 Billion (within 15 months)

$20,000,000 buys 20.00% ownership interest of the Property, yielding $3,100,000,000 (3.1 billion) in Sale Proceeds

$1,000,000 buys 1.00% ownership interest of the Property, yielding $155,000,000 in Sale Proceeds

$500,000 buys 0.5% ownership interest of the Property, yielding $77,500,000 in Sale Proceeds

$250,000 buys 0.25% ownership interest of the Property, yielding $38,750,000 in Sale Proceeds

Accredited Investors with interest should request the Private Placement Memorandum and working interest purchase and sale agreement.

THIS IS NOT INTENDED TO BE TAX ADVICE. TAX LAWS ARE SUBJECT TO CHANGE. DO NOT RELY UPON THIS LETTER OR THE COMPANY’S COUNSEL WITH RESPECT TO ANY TAX CONSEQUENSES RELATED TO THE OWNERSHIP, PURCHASE, OR DISPOSITION OF THE WORKING INTEREST. YOU ARE ENCOURAGED TO CONSULT WITH YOUR OWN TAX ADVISOR WITH RESPECT TO YOUR OWNERSHIP OF A WORKING INTEREST IN THIS GOLD PROJECT.

Highlights

- Status:

- Available

- Price:

- $20,000,000

- Cap Rate:

- 20.00%

Property Information

- Property Type:

- Gold

- Industry Type:

- Gold

- Units/Spaces:

- 1

- Land Area:

- 7,500.00 acres

- Purchase Tenure:

- Fee Simple

Existing financing information

- N/A

The information contained herein contains confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient will be prohibited. The information contained herein has been obtained from sources believed to be reliable. While we do not doubt its accuracy, we have not verified it and make no guarantee, warranty or representation about the accuracy or completeness of the information. As a buyer, it is your responsibility to independently confirm its accuracy and completeness. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the property. The value of this property to you depends on factors which should be evaluated by your tax, financial and legal advisors. You and your advisors should conduct a careful, independent investigation of the property to determine to your satisfaction the suitability of the property for your needs. We have no knowledge of this offering other than the information received from Seller or their representatives. We are neither your agent or an agent for the seller. We will not participate in the negotiation of the purchase price or attend the showing of this property. As a buyer, you will be required to indemnify us and hold us harmless from any kind of claim, cost, expense, or liability arising out of your investigation and/or purchase of this property.